Get the latest Pepe news, prices, real-time exchange rates, market trends, and price predictions.

Pepe News: 17/07/2025

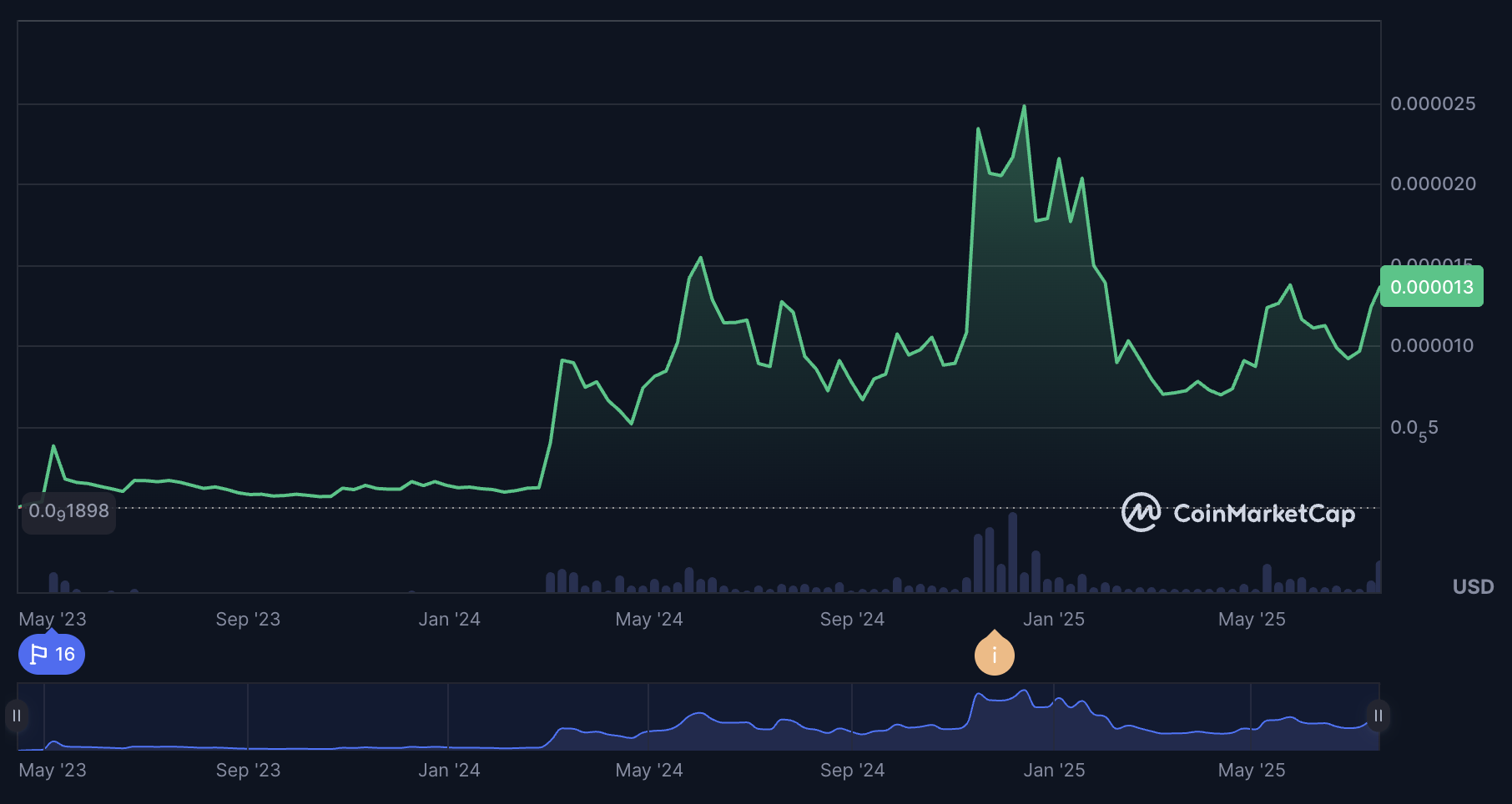

Pepe’s 4.9% 24-hour gain aligns with Ethereum’s rally, bullish technicals, and memecoin sector momentum.

- Ethereum’s surge lifted ETH-based memecoins like PEPE.

- Cup-and-handle breakout targets $0.000025, per technical analysis.

- Memecoin market cap surged 29% in July, boosting speculative interest.

1. Primary Catalyst: Ethereum Rally

Ethereum rose 6.2% to $3,341, driving capital into ETH-based assets. PEPE’s 24-hour volume spiked 43.7% to $2.54B, reflecting retail inflows tied to ETH’s momentum.

2. Technical Breakout Signals

- Cup-and-handle pattern: Confirmed on July 17, targeting $0.000025.

- MACD bullish crossover: Histogram widened to +0.000000371, signaling accelerating momentum.

- RSI at 70.69: Near overbought but not extreme, leaving room for upside.

3. Memecoin Sector Momentum

The memecoin market cap grew 29% in July to $72B (CMC News), with PEPE up 22% this week. Traders rotated into high-beta tokens as the Altcoin Season Index rose 30% weekly.

PEPE’s rally reflects Ethereum’s strength, technical optimism, and sector-wide memecoin demand. Watch the $0.000014 Fibonacci extension level for confirmation of continued upside.

What’s next: Can PEPE sustain momentum if ETH faces resistance near $3,500?

What is the latest news on PEPE?

PEPE shows bullish momentum (+23% weekly) fueled by Ethereum’s rally, retail inflows, and technical breakouts, though overbought signals and whale profit-taking pose risks.

- +463K holders signal growing retail adoption

- Ethereum’s 6.2% surge drives memecoin demand

- Overbought RSI (64) flags short-term correction risk

Deep Dive

1. Market Metrics

PEPE hit $0.000014 on July 16 – a 45-day high – with $2.48B 24H volume (+46% vs prior day). Retail traders dominate recent moves:

- Whale transactions (>$100K) dropped 33% to $166M (vs $248M peak on July 11)

- Holder count crossed 463,000, up 2.8% monthly, indicating grassroots adoption

2. Technical Developments

- Ethereum ecosystem tailwinds:

PEPE’s 30% weekly gain aligns with ETH’s 6.2% rise and leadership changes at Ethereum Foundation - Key levels:

Resistance: $0.0000135 (upper Bollinger Band)

Support: $0.0000108 (mid-Bollinger) – 20% below current price

3. Community & Governance

- High-risk speculation: Trader James Wynn opened $23.9M BTC long and leveraged PEPE positions using referral rewards, risking 100% loss on 10% price dip

- Derivatives activity: Open interest rose 8.2% to $705M, with longs paying 0.0107% funding rate to maintain positions

PEPE’s rally combines Ethereum’s momentum, retail FOMO, and technical setups, but sustainability hinges on holding $0.0000125 support. Can PEPE decouple from ETH if the broader market corrects?

Check out the Pepe page for the latest update

CMC AI can make mistakes, please DYOR. Not financial advice.