Get the latest Flare news, prices, real-time exchange rates, market trends, and price predictions.

Flare News: 17-07-2025

Flare's 5% price rise in 24 hours reflects DeFi adoption momentum and strategic ecosystem incentives.

- DeFi Incentives: 2.2B FLR program launched to boost XRPFi adoption.

- Network Utility: 73% of FLR staked/delegated, daily gas burns reduce supply.

- Technical Breakout: RSI (79.32) signals strong buying pressure, MACD bullish crossover.

1. Primary Catalyst

The 2.2B FLR incentive program launched July 2025 targets DeFi growth, particularly for XRPFi – Flare’s XRP-focused DeFi ecosystem. This aligns with FLR’s 12% 7-day rally and $170M TVL milestone. The program rewards liquidity providers and stakers, directly increasing demand for FLR as the utility token.

2. Supporting Factors

- Token burns: 4K–7K FLR burned daily from fees, with 66M burned July 5.

- Staking lockup: Over 73% of FLR supply is staked/delegated, reducing sell-side pressure.

- XRPFi anticipation: FXRP (synthetic XRP) and stXRP (liquid staking) integrations could unlock billions in idle XRP capital.

3. Technical Context

- Bullish indicators: RSI7 at 79.32 (overbought but momentum-driven), MACD histogram positive at +0.000193.

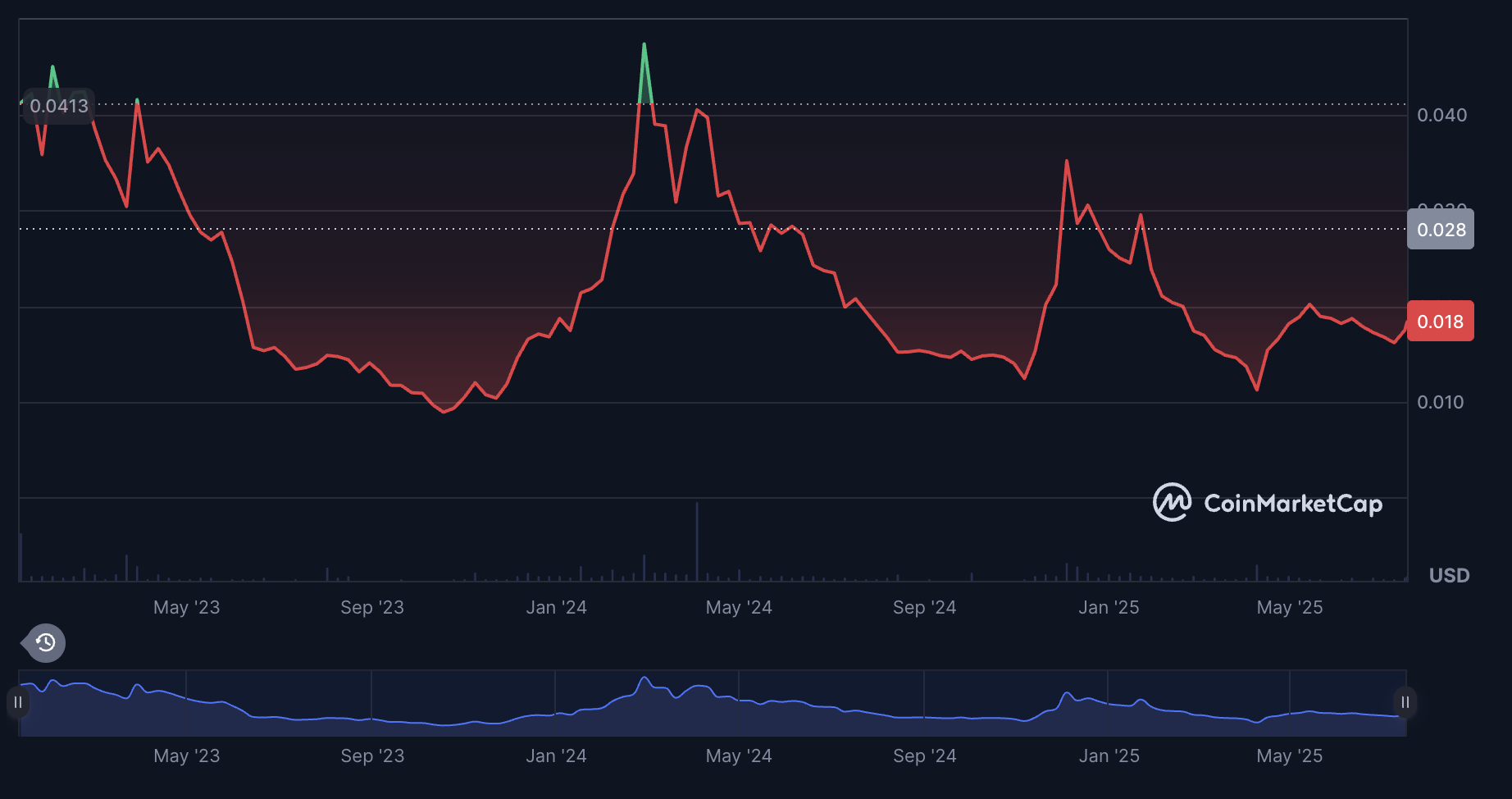

- Price levels: Broke above 23.6% Fibonacci resistance ($0.017583), eyeing $0.0192 (127.2% extension).

- Volume rose 61% to $15.47M, confirming buyer conviction.

FLR’s rally combines strategic ecosystem incentives, supply constraints, and bullish technicals. With XRPFi adoption accelerating and stablecoin liquidity nearing $150M, watch whether FLR sustains above its 200-day EMA ($0.0189). Could Flare’s focus on XRP-based DeFi help it decouple from broader market trends?

What is the latest news on FLR?

Flare shows bullish momentum with major DeFi incentives and partnerships, though recent outflows signal short-term volatility risks.

- 2.2B FLR DeFi incentive program launched to boost adoption

- TrustSwap integration enables institutional-grade token launches

- $13.58M outflows in 24h despite ecosystem growth

1. Business & Partnerships

Flare partnered with TrustSwap and Team Finance on July 10 to streamline token launches, with SparkDEX’s TVL growing from $25M to $100M since May. The network secured custody integration with BitGo (June 2025) and expanded its Google Cloud collaboration for decentralized data feeds.

2. Technical Developments

The July 15 anniversary update revealed:

- 240M transactions processed since 2022 mainnet launch

- FAssets protocol nearing mainnet release, enabling XRP→FXRP conversions

- Gas fee burns consuming 4K-7K FLR daily, with 2.1B tokens burned to date

- 73% FLR staked, creating structural scarcity

- 240M transactions processed since 2022 mainnet launch

- FAssets protocol nearing mainnet release, enabling XRP→FXRP conversions

- Gas fee burns consuming 4K-7K FLR daily, with 2.1B tokens burned to date

- 73% FLR staked, creating structural scarcity

3. Market Metrics

While FLR gained 12.94% this week, the July 14 report showed $13.58M outflows in 24h. Turnover ratio (1.15%) suggests moderate liquidity, with 55% volume spike potentially indicating profit-taking after the 21.94% 90-day rally.

Flare’s ecosystem growth through XRPFi integrations and tokenomics improvements contrasts with recent capital rotation. Will FXRP adoption outpace sell pressure from incentive unlocks? Monitor the FAssets mainnet rollout and FLR burn rate acceleration this quarter.

Check out the Flare page for the latest update.

CMC AI can make mistakes, please DYOR. Not financial advice.