Get the latest Aave news, prices, real-time exchange rates, market trends, and price predictions.

AAVE News: 17/07/2025

Aave’s 24-hour price decline (-2.18%) reflects profit-taking after recent gains, technical resistance, and market-wide risk recalibration despite bullish fundamentals.

- Profit-taking after 9% weekly gains and V4 upgrade anticipation

- Technical resistance near $330 Fibonacci level

- Market rotation toward newer narratives amid altcoin season

1. Profit-Taking Momentum

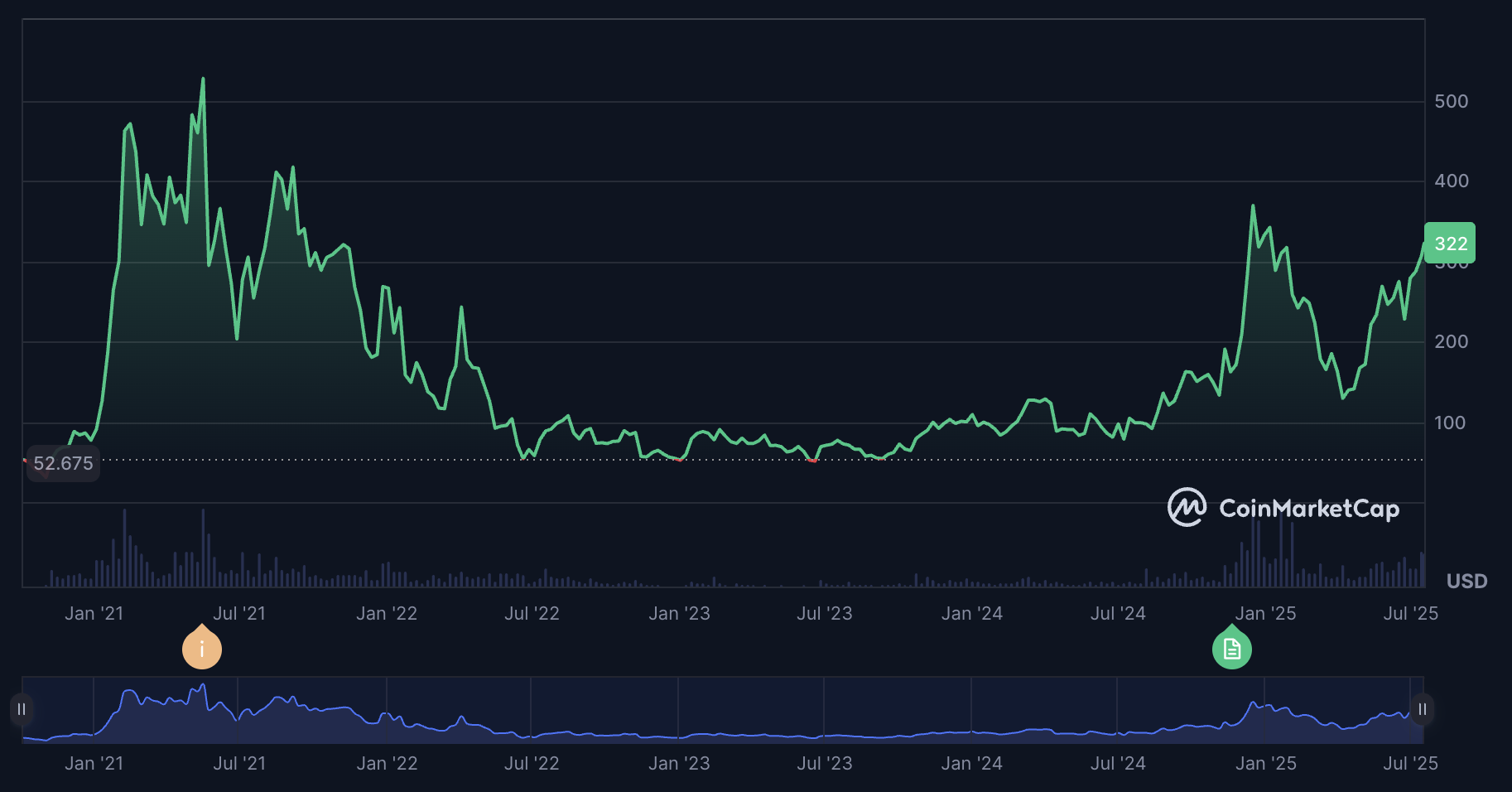

- AAVE surged 131% in 90 days, reaching $334.71 on July 16 before cooling to $322.31

- Traders likely locked gains after Bitcoin’s rally to $120K stalled, with crypto market turnover dropping -33% in spot markets (CoinMarketCap Global Metrics)

- The proposed Aave v4 upgrade (unified liquidity layer, GHO integration) has been priced in since its June 30 announcement, creating a "buy rumor, sell news" dynamic

2. Technical Resistance

- Price faces resistance at the 23.6% Fibonacci level ($306.28) and pivot point ($326.56)

- RSI 14 at 66.01 suggests cooling momentum from overbought conditions (7-day RSI peaked at 72.18)

- The MACD histogram (+3.73) remains positive but shows decelerating bullish divergence

3. Market Dynamics

- Altcoin season index rose +80% in 30 days, favoring newer tokens over established DeFi blue-chips like AAVE

- ETH-linked pressure: Arthur Hayes’ "ETH season" declaration shifted focus to L2s and restaking plays, with AAVE’s correlation to ETH weakening to 0.78 (30-day rolling)

- Institutional flows favored Bitcoin (+$11.38B ETF inflows) and Ethereum (+$2.41B) over DeFi tokens

Aave’s dip appears corrective within a larger uptrend, driven by natural profit cycles and sector rotation rather than protocol weakness. The $305 support (7-day SMA) and $288 (38.2% Fib) will test whether this is a healthy reset or deeper pullback.

What catalyst could reignite AAVE’s uptrend? Monitor progress toward the Q3 2025 V4 launch and GHO stablecoin adoption in RWA markets.

What is the latest news on AAVE?

Aave shows bullish momentum with a 72% Q2 gain and record $50B deposits, driven by protocol upgrades and regulatory tailwinds, though large institutional debt repayments pose short-term risks.

- TVL surged 57% YTD to $30B

- V4 upgrade introduces cross-chain liquidity layer

- $150M ETH sale by Trend Research to repay Aave loans

1. Market Metrics

- Price: AAVE rose 11.7% this week to $330 (as of July 17), nearing its 2025 high of $331.80 (CoinMarketCap).

- TVL: Deposits hit $50B on July 14 across 34 chains, rivaling mid-sized U.S. banks. Protocol fees reached $48M in June, up 60% since April.

2. Technical Developments

- V4 Upgrade: Launched June 30, introducing unified liquidity hubs and spokes for cross-chain borrowing. This could reduce gas costs by 30% and enable Bitcoin collateralization.

- GHO Expansion: Aave’s stablecoin launched on Avalanche (July 15) with $10M initial cap, leveraging Chainlink’s CCIP for bridging.

3. Regulatory & External Factors

- GENIUS Act Progress: Proposed U.S. legislation could clarify DeFi compliance, potentially accelerating institutional adoption of Aave’s RWA initiatives.

- Debt Repayment Risk: Trend Research sold 48,900 ETH ($150M) on July 16 to cover Aave loans, with $207M debt remaining. Full repayment could require selling 40K more ETH ($120M), creating temporary sell pressure (CMC).

Aave’s fundamentals strengthened through technical innovation and macro tailwinds, though monitor on-chain whale activity for liquidity shifts. Could the V4 upgrade help Aave capture institutional RWA demand before ETH ETF approvals?

Check out the AAVE page for the latest update.

CMC AI can make mistakes, please DYOR. Not financial advice.